Data Integrity for Providers, Employees, and Vendors

Connect our enhanced primary source data to the moments and workflows you need most with ProviderTrust, the industry’s most accurate dataset for credential verification and ongoing exclusion monitoring.

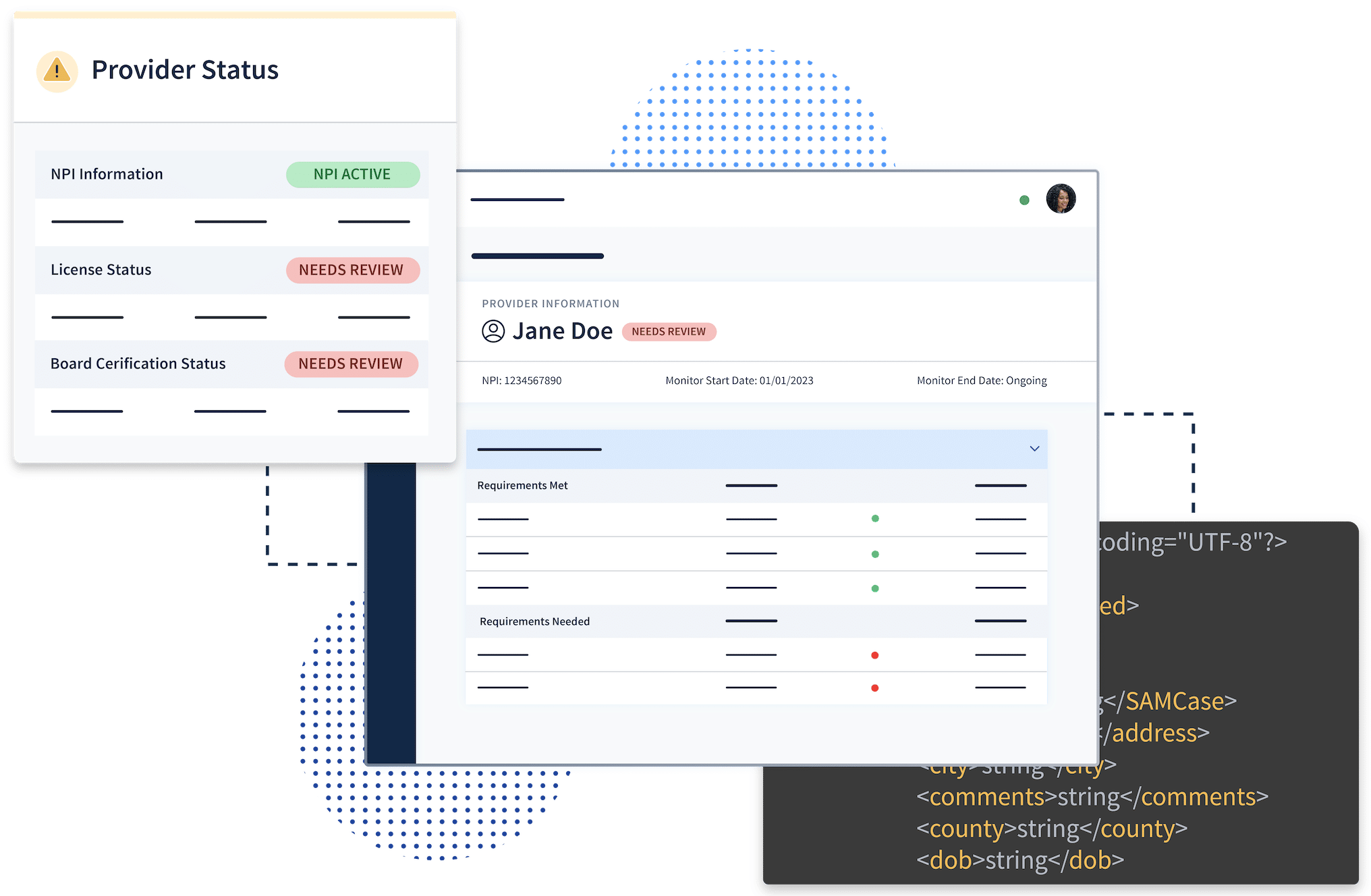

Verified Results Delivered within Your System of Record

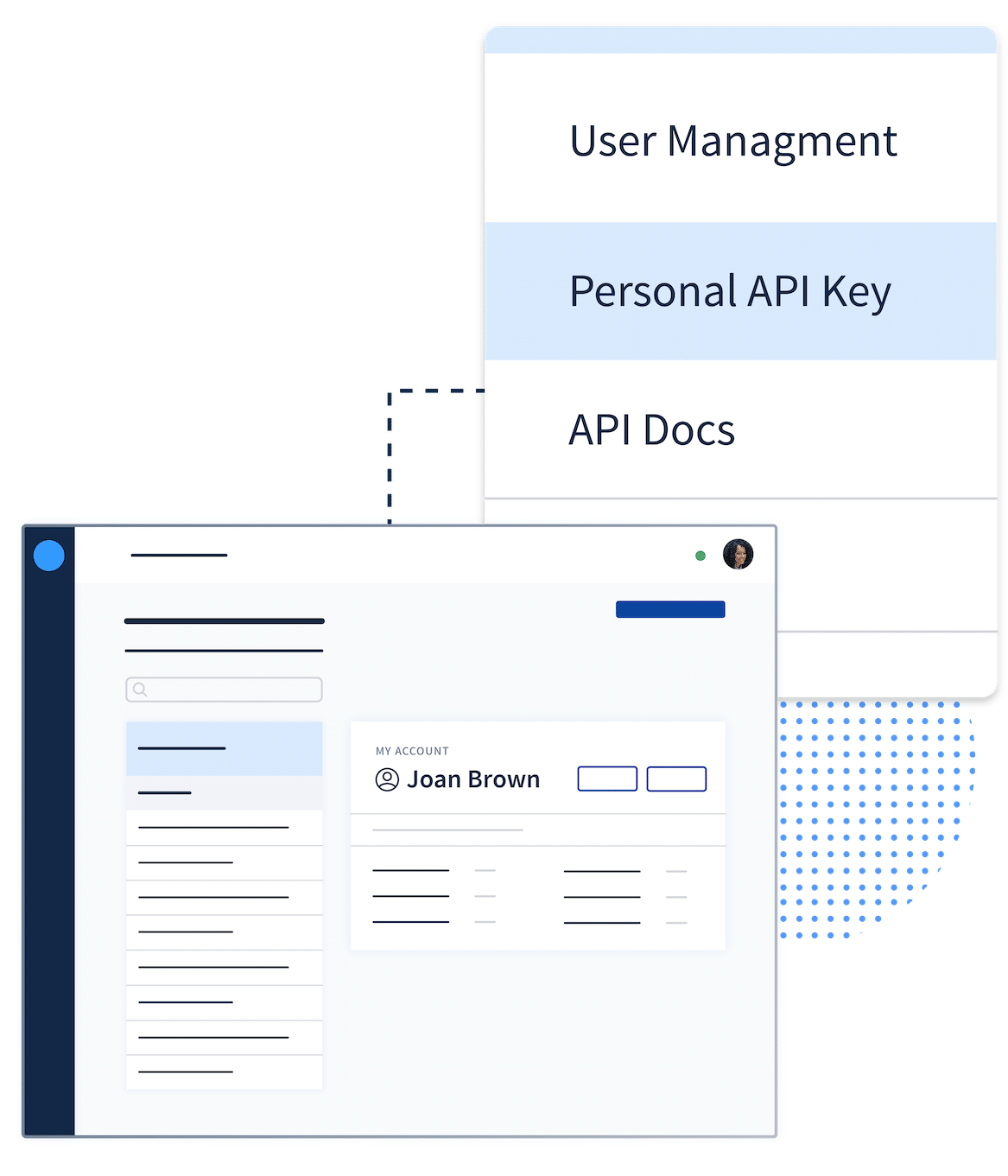

Connect the power and sophistication of ProviderTrust’s enhanced primary source data, delivering automated verification results and monitoring insights via API or SFTP right within your systems and workflows.

43m+

License Verifications Performed Annually

51%

Exclusions Found Only with Our Enhanced Primary Source Data

10m+

People and Entities Monitored Ongoing

Trusted by 7 of the top 10 healthcare organizations in the nation.

There’s a reason that 7 of the top 10 leading healthcare organizations leverage ProviderTrust to ensure data accuracy, improve efficiencies, mitigate risk, and save time and costs.

Explore why our data is different.

Payers

Eliminate Network Redundancies and Save Time, Even with Limited Data

Leverage ProviderTrust’s NCQA-certified solutions to ensure ongoing eligibility throughout a provider’s entire lifecycle with a health plan. Our reimagined approach to credentialing processes and provider data accuracy speeds up the time to credential and re-credential, eliminates redundancies in your networks, and saves your organization time and costs.

of verifications are automated and delivered within 2 days

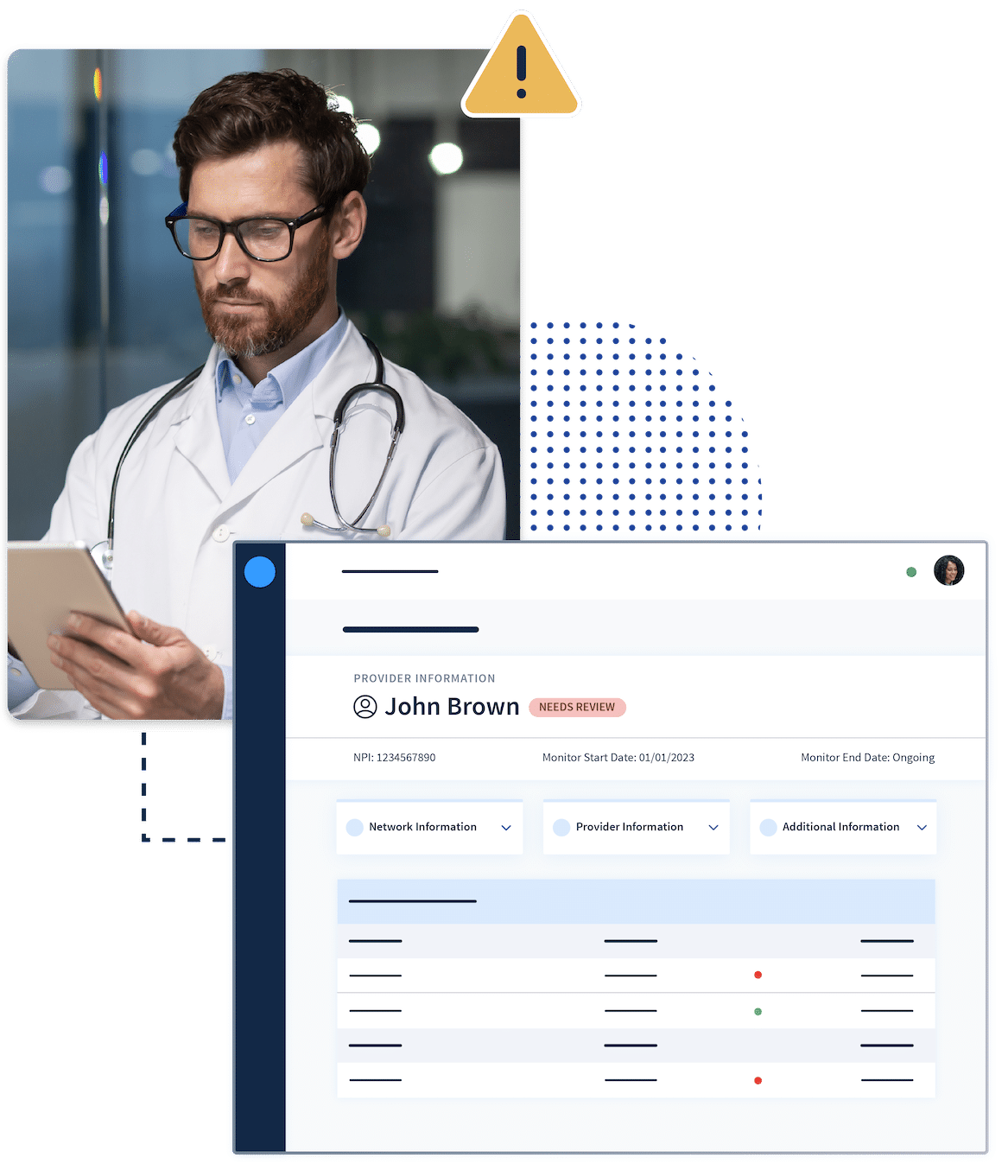

Providers

Improve Operational Efficiencies, Mitigate Risk, and Cut Costs with One Single Data Source

For over a decade, ProviderTrust has led the way in upholding industry-leading standards in license verification and OIG exclusion monitoring for healthcare employees, vendors, and physician networks. With our enhanced primary source data, we help Compliance, Human Resources, and Credentialing teams reduce network redundancies, automate complicated staffing workflows, and reduce fraud, waste, and abuse. We catch and prevent more issues than any other vendor.

of all exclusions we find are likely missed by other vendors or systems

Partners

A Connected Healthcare is a Strategic Healthcare

At ProviderTrust, our mission is simple: to create a safer healthcare for all. We achieve that goal by partnering with other industry-leading technologies and services to create new avenues of connectivity and interoperability. Healthcare is stronger when we work together. Strengthen your organization’s positioning through strategic integration of healthcare’s leader in always-accurate data for provider networks, employees, and vendors.

“Not only has ProviderTrust saved us countless hours of unnecessary work and delivered peace of mind that no exclusions will be missed, but their solution is also the most polished one that we work with, and we are frequently complimented on how organized our credentialing files and programs are.”

“It's a real problem if you have an excluded individual on your workforce or an excluded entity or contractor as a vendor. It's comforting to know that I can confidently report to the Board Compliance Committee that we are doing everything we are supposed to be doing to make sure we are not employing or contracting with excluded individuals or entities. ProviderTrust's services are of high value to us.”

“What we've got right now is a place that we can go at any time and look at a point-in-time verification for an employee since ProviderTrust does this quarterly on top of license renewal. I'm able to look at any given time and see a clean PSV, and I'm able to pull that and put it into an employee's file and not stress out because the website for the state is not working today. We've not had issues with things not getting verified.”

“By using ProviderTrust, it has eliminated all of the manual work that we have to do but it's also given us piece of mind that we're not going to have the government knocking on our door because ProviderTrust is going to make sure that we have all the tools that we need to function and do our job effectively.”

Featured Resources

Guides

Exclusion List Monitoring Solution Guide

Exclusions

OIG

Providers

January 01, 2022

Read More

Guides

Ongoing Credential Verification Infographic

Licenses and Credentials

Payers

Providers

November 28, 2023

Read More

Case Studies

Meharry Medical College Achieves Fully Automated Compliance Vendor Monitoring

Providers

Vendor Compliance

October 27, 2022

Read More